Building Envelope Market Size to Cross USD 201.63 Billion by 2034

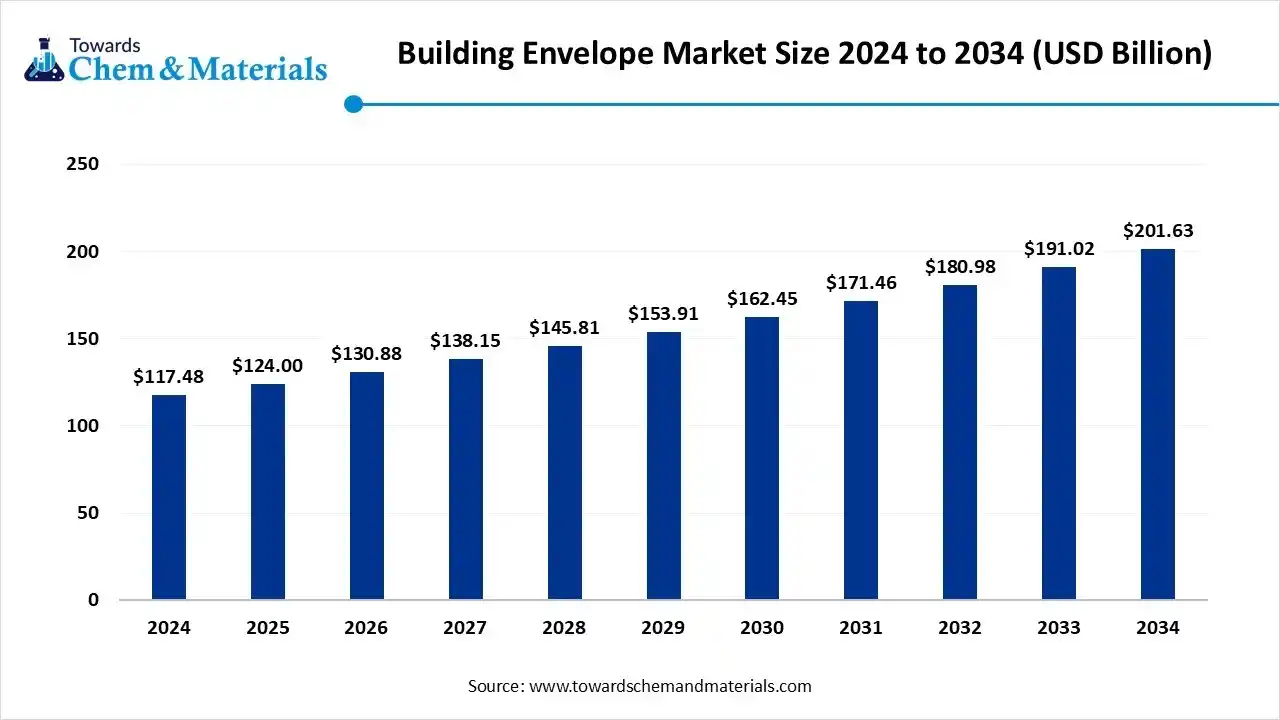

According to Towards Chemical and Materials, the global building envelope market size is calculated at USD 124 billion in 2025 and is expected to be worth around USD 201.63 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period 2025 to 2034.

Ottawa, Oct. 15, 2025 (GLOBE NEWSWIRE) -- The global building envelope market size was valued at USD 117.48 billion in 2024 and is anticipated to reach around USD 201.63 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5889

Building Envelope Overview

The building envelope market is experiencing significant growth, driven by the increasing demand for energy efficient and sustainable construction solutions. This growth is further supported by advancements in materials and technologies that enhance the performance and durability of building envelops. Key drivers include stringent building codes, rising energy costs, and a heightened awareness of environmental impacts. The market encompasses various segments, including walls, roofs, windows and doors, each contributing to the overall performance of the building envelope. As urbanization continues to rise, the need for innovative building envelope solutions becomes more pronounced, positioning this market for continued expansion in the coming years.

Building Envelope Market Report Highlights

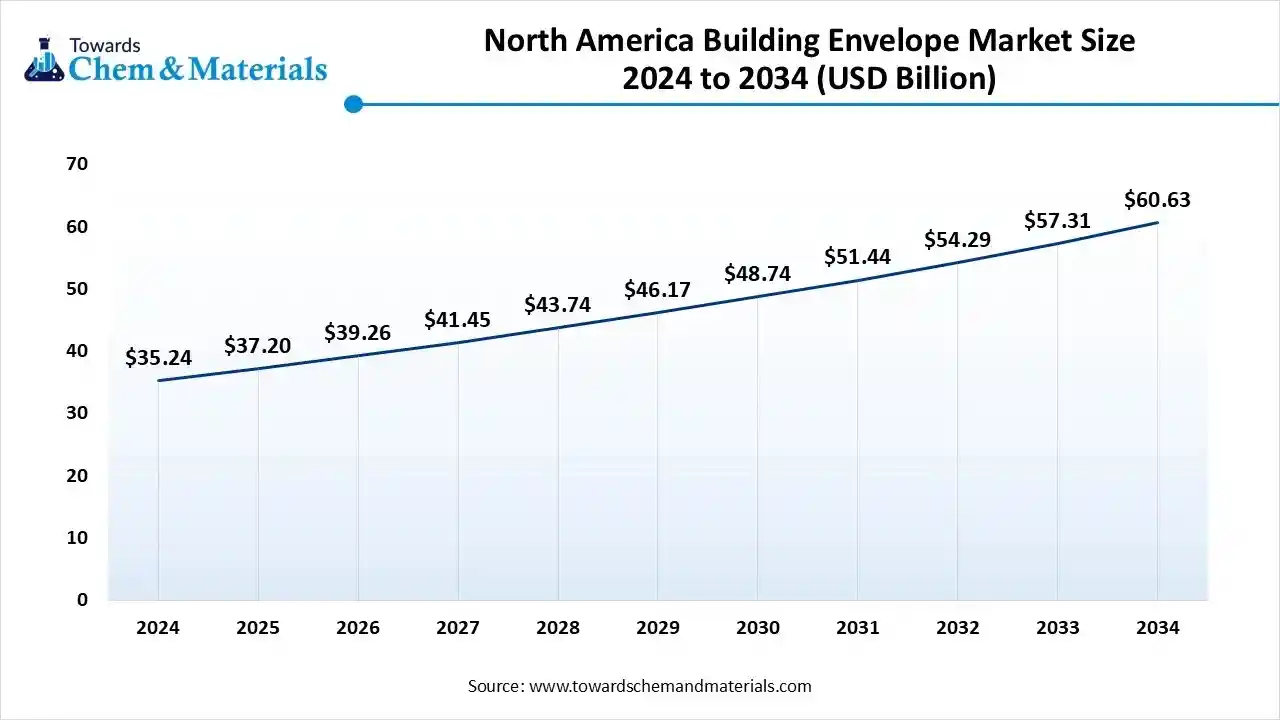

- The North America building envelope market size was valued at USD 35.24 billion in 2024 and is expected to surpass around USD 60.63 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.58% over the forecast period from 2025 to 2034.

- The North America dominated the market with a 30% industry share in 2024.

- By material type, the glass segment led the market with 30% industry share in 2024.

- By product type, the wall systems segment emerged as the top-performing segment in the market with 40% industry share in 2024.

- By building type, the commercial building segment led the market with a 45% share in 2024.

- By technology, the smart and energy-efficient solutions segment emerged as the top-performing segment in the market with 50% industry share in 2024.

- By installation type, the renovation & retrofitting segment led the building envelope market with a 60% share in 2024.

Why is this important?

High-performing envelopes (the parts of a building that separate the indoors from the outdoors, including exterior walls, foundations, roof, windows, etc.) are the most effective way to reduce the thermal needs of buildings. Compared to other solutions, the selection of envelope structure and materials is particularly important given the long lifetime of buildings and the cost of construction.

What is the role of building envelopes in clean energy transitions?

Efficient building design, integrating high-performing envelopes, is the most effective way to reduce the thermal needs of buildings and ensure occupants’ thermal comfort. Compared to other solutions in buildings, the selection of envelope structure and materials is particularly important, given the long lifetime of buildings and the associated cost of the envelope.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5889

Building Envelope Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 130.88 billion |

| Revenue forecast in 2034 | USD 201.63 billion |

| Growth rate | CAGR of 5.55% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Segments covered | By Material Type, By Product Type, By Building Type, By Technology, By Installation Type, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar |

| Key companies profiled | Saint-Gobain; Owens Corning; Kingspan Group; Rockwool International; BASF SE; DuPont de Nemours; GAF Materials Corporation; Sika AG; Etex Corp; 3M Company |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some Of The Top Products In The Building Envelope Market

1. Insulation Materials (e.g., Stone Wool, SPF, EPS/XPS)

Enhance thermal performance and energy efficiency in walls, roofs, and façades.

2. Cladding Systems (e.g., Fiber Cement, Metal Panels, Composite Panels)

Provide exterior protection, aesthetics, and weather resistance.

3. Roofing Systems (e.g., Shingles, Tiles, Metal Roofing)

Protect the building from weather while contributing to thermal performance.

4. Façade Panels (e.g., Precast Concrete, Aluminum, Glass Panels)

Structural and decorative elements that form the outer shell of buildings.

5. Air and Vapor Barriers

Control moisture movement and air leakage, improving indoor climate and energy use.

6. Glazing Systems (e.g., Curtain Walls, Double/Triple Glazing)

Transparent or translucent systems offering daylighting and thermal control.

7. Doors and Windows (High-Performance Units)

Sealed, insulated, and often double- or triple-glazed for energy efficiency.

8. Sealants and Adhesives

Ensure tight sealing between materials and prevent moisture or air infiltration.

9. Weather-Resistant Barriers (WRBs)Membranes or wraps that shield buildings from rain, wind, and external conditions.

10. Smart Building Envelope Systems (e.g., Automated Shades, Integrated Controls)

Technology-driven components that adapt to environmental conditions for comfort and efficiency.

What Are The Major Trends In The Building Envelope Market?

- The adoption of intelligent building envelopes is on the rise, incorporating sensors and automation systems to enhance energy efficiency and occupant comfort.

- There is growing preference for eco-friendly materials and designs that minimize environmental impact, aligning with global sustainability goals.

- Innovations in insulation technologies are improving thermal performance, contributing to energy conservation and cost savings in buildings.

- The use of prefabricated building envelope systems is expanding, offering benefits like reduced construction time and improved quality control.

How Does AI Influence The Growth Of The Building Envelope Market In 2025?

Artificial Intelligence (AI) is poised to significantly influence the building envelope market in 2025 by enhancing design, performance, and sustainability. AI facilitates the creation of optimized building envelopes through generative design, enabling architects to explore numerous design alternatives that meet specific performance criteria, such as energy efficiency and structural integrity. This approach allows for the integration of complex environmental data, leading to designs that are better adapted to local climates and energy demands. Additionally, AI-powered stimulations and predictive analytics enable real time monitoring and maintenance of building envelops, identifying potential issues like air leaks or moisture intrusion before they become critical, thereby extending the lifespan of materials and reducing maintenance costs.

Building Envelope Market Dynamics

Growth Factors

Can Smarter Materials Transform Envelopes into Energy Savers?

AI is accelerating the development of smart and adaptive materials for building envelopes, enabling facades that change properties in response to heat, light, or humidity. These materials can improve insulation, reduced heat losses, and dynamically modulate solar gain, shifting the envelope from a passive barrier to an intelligent skin. By embedding sensors and control logic, such materials also help monitor performance and predict maintenance needs. This reduces operational energy use and extends material lifespan, making high performance envelops more attractive. The trend is supported by research into responsive and self-healing material systems that adapt over time.

Could Tougher Energy Codes Force Better Envelopes?

Tighter building energy codes and performance standards are pushing designers and builders to use higher performing envelopes to meet regulatory demands. As jurisdictions update their codes to reduce emissions and increase efficiency, envelopes must offer lower thermal losses and better airtightness. This regulatory pressure encourages innovation and adoption of advanced envelop solutions that meet stricter thresholds. When codes require compliance with performance metrics, envelope upgrades become not just optional, but essential. In turn, this drives market demand for envelope systems that can reliability satisfy those standards.

Market Opportunity

Could Bio-Biased Insulation Materials Open A New Frontier?

The rise of renewable and bio-based materials like hemp clay composites, straw boards, and mycelium-based insulation presents an opportunity for the building envelope sector to reduce embodied carbon while offering competitive thermal performance. Architecture and design forums are highlighting these materials as the next wave of sustainable construction.

Can Advanced Façade Tech Beat Urban Heat Effect?

Facades using cool surfaces, reflective coatings, or green systems help reduce urban heat, creating opportunities for envelope makers to move beyond energy savings. Such solutions appeal to cities and developers focused in climate resilience. This trend expands the role of envelopes in urban adaption.

Limitations In The Building Envelope Market

- The high upfront costs of advanced materials and high performance envelope systems create a barrier for adoption in price sensitive projects.

- The diversity of regulations and the need to comply with various building codes across regions increase complexity of manufacturers and installers.

Building Envelope Market Segmentation Insights

Material Type Insights

Why Is Glass Segment Dominating The Building Envelope Market?

The glass segment dominated the market in 2024. The dominance of glass in building envelopes comes from its versatility, aesthetic values, and ability to enhance natural light within buildings. Architects and developers favour advanced glazing solutions that balance energy efficiency with design flexibility, making glass an essential component in modern construction projects. Technological advancements such as low emissivity coatings and insulated glazing units have further increased its adoption, as they improve thermal performance while maintaining transparency.

Metal Segment is projected to experience the fastest rate of market growth from 2025 to 2034. Metal is gaining momentum due to its durability, recyclability, and ability to meet the demands of sustainable contortion. The growing focus on resilient building materials, combined with the versatility of metals like aluminium and steel, is pushing their adoption in facades, cladding, and roofing systems. Additionally, lightweight properties and ease of installation make metals attractive for both new construction and retrofitting projects.

Product Type insights

Why Are Wall Systems Segment Dominating The Building Envelope Market?

The wall systems segment registered its dominance over the market in 2024. Wall systems play a central role in defining the structural integrity and thermal performance of buildings, making them indispensable in the construction process. Their ability to improve insulation, reduce air leakage, and provide enhanced fire resistance drives their adoption across diverse projects. Continuous innovation in curtain walls, insulated energy efficiency. With builders and architects prioritizing sustainable and functional building shells, wall systems remain a cornerstone of the building envelope industry.

The window and doors segment is projected to expand rapidly in the market in the coming years. Rising demand for energy efficient fenestration systems is driving the adoption of advanced windows and doors that reduce heat transfer and enhance indoor comfort. Smart technologies such as automated shading, triple glazing, and insulated frames are transforming he role of these components beyond basic access and ventilation.

Building Type Insights

Why Are Commercial Buildings Segment Dominated The Building Envelope Market?

The commercial buildings segment maintained a leading position in the market in 2024. This dominance is fuelled by extensive construction of office spaces, shopping complexes, institutional buildings, and healthcare facilities that require high performance building envelopes. Commercial projects often prioritize energy efficiency. Safety, and design aesthetics, pushing demand for advanced envelope material and technologies, renovation and retrofitting of older commercial structures to comply with green building envelopes. Commercial projects often prioritize energy efficiency, safety, and design aesthetics, pushing demand for advanced envelope materials and technologies. Renovation and retrofitting of older commercial structures to comply with green building standards also contribute to this segment’s dominance. As sustainability becomes a standard requirement in the commercial sector, the reliance on modern building envelope systems continues to strengthen.

The residential buildings segment is projected to experience the highest growth rate in the market between 2025 and 2034. Rising urbanization and increasing housing demand are fuelling investments in residential construction globally. Homeowners are becoming more conscious of energy efficiency, leading to greater adoption of insulated walls, energy efficient windows, and smart roofing solutions. Government incentives for sustainable housing and growing awareness windows, and smart roofing solutions. Government incentives for sustainable housing and growing awareness of indoor comfort are also supporting this trend.

Technology Insights

Why Are Smart Solutions Segment Dominating The Building Envelope Market?

The smart and energy efficient solutions segment dominated the market in 2024. These technologies are becoming central to modern building designs as they enhance performance, reduce energy use, and improve occupant comfort, smart building envelopes integrate automation, sensors, and responsive materials that adapt to changing environmental conditions. With stricter energy codes and the rising popularity of green certifications, these solutions are increasingly being integrated into both commercial and residential projects.

The solar integrated building envelopes segment is projected to expand rapidly in the market in the coming years. Growing global emphasis on renewable energy is encouraging the use of energy production, making them more sustainable. This dual functionality appeals to developers seeking to reduce carbon footprints and operating costs. As demand for energy producing building elements grows, solar integrated envelopes are emerging as a key growth driver in the market.

Installation Type Insights

Why Is Renovation And Retrofitting Dominating The Building Envelope Market?

The renovation and retrofitting segment dominated the market in 2024. The dominance of this segment stems from the widespread need to upgrade aging building require improved insulation, air sealing, and façade upgrades to reduce energy consumption and extend their lifespan. Retrofitting also allows property values. As sustainability and energy efficiency targets become stricter, renovation and retrofitting will continue to dominate the installation type segment.

The new construction segment is projected to experience the fastest rate of market growth from 2025 to 2034. Rapid urbanization and expanding infrastructure projects worldwide are fuelling demand for new, high performance building envelopes. New construction projects offer the opportunity to integrate the latest technologies and sustainable materials from the outset, making them highly attractive for builders.

Regional Insights

Why Is North America The Dominant Region In Building Envelope Market?

The North America building envelope market size was valued at USD 35.24 billion in 2024 and is expected to surpass around USD 60.63 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.58% over the forecast period from 2025 to 2034. North America dominated the market in 2024,

North America dominated the building envelope market in 2024, thanks to a mature construction industry, robust investments in energy efficiency, and strict regulatory frameworks driving upgrades to building shells. Developers and building owners in North America increasingly demand high performance envelope systems to meet codes, sustainability goals, and occupant comfort standards, which bolsters adoption of advanced materials and smart facades. The region also hosts major industry players and innovation clusters, reinforcing its influence in product development, supply chain, and standard setting. These strengths together underpin North America’s dominance in the global building envelope space.

Within North America, the U.S. plays a pivotal role due to its large construction federal and state policies promoting green construction, and string market, federal and state policies promoting green construction, and strong standards like ASHRAE and LEED that push envelope performance. U.S. demand is further fuelled by retrofits of gaining building stock, urban redevelopment, and rising interest in net-zero and resilient building stock, urban redevelopment, and rising interest in net-zero and resilient building design.

Why Is Asia Pacific The Fastest Growing Region In Building Envelope Market?

Asia Pacific expects the fastest growth in the building envelope market during the forecast period, driven by rapid urbanization, booming infrastructure development, and ever increasing construction activity across emerging economies. In many countries of the region, governments are pushing green building initiates and energy efficiency regulations, which raise the demand for high performance envelopes. The surge in residential and commercial building projects, particularly in dense urban areas, is fuelling absorption of advanced façade systems, glazing and insulation solutions.

Within Asia Pacific, China is playing a dominant role in the building envelope market owing to its massive scale of construction, strong government backing for energy standards, and steady investment in sustainable infrastructure. Its policies promoting green buildings, retrofit programs, and stricter codes are reinforcing demand for advanced envelope systems.

What is Europe Building Envelope Market Trends

Europe building envelope industry remains a leader in sustainable construction practices, heavily influenced by the EU’s Energy Performance of Buildings Directive. Countries such as Germany, France, and the UK are enforcing strict efficiency standards that boost demand for advanced building envelope systems. Adoption of green certifications like BREEAM is widespread across commercial and residential projects. The region has a mature construction sector with an emphasis on retrofitting older buildings to meet modern standards. Innovation in glazing, insulation, and lightweight materials continues to expand. Europe also leads in the use of advanced façade technologies integrating renewable energy.

Germany building envelope industry is one of the most advanced markets for building envelopes, owing to its strict energy efficiency regulations and focus on sustainable building. The country has seen widespread adoption of Passivhaus standards, which prioritize airtight and highly insulated building envelopes. Germany’s advanced manufacturing base supports innovations in glazing and façade solutions. The retrofitting of older housing stock remains a significant driver of demand. In addition, government support for renewable energy integration in buildings is encouraging the adoption of solar facades. Germany’s emphasis on quality and sustainability ensures its leadership in the European market.

What is Central & South America Building Envelope Market Trends

The building envelope industry in Central & South America is growing steadily due to rising urbanization and increased investments in residential and commercial infrastructure. Countries such as Brazil and Mexico are leading the adoption of efficient construction practices. Although regulations are less stringent compared to North America and Europe, the growing influence of global green building certifications is shaping demand. Affordability remains a key factor, with many local players offering cost-effective insulation and façade solutions. The region also has potential for prefabricated and modular construction, further boosting the market.

What is Middle East & Africa Building Envelope Market Trends

The Middle East & Africa building envelope industry is expanding rapidly due to mega infrastructure and smart city projects, particularly in the Gulf region. High demand for energy-efficient solutions is driven by extreme climatic conditions that necessitate advanced insulation and glazing. Saudi Arabia, the UAE, and Qatar are investing heavily in green building initiatives. Africa is witnessing increasing urban development, though affordability challenges persist. International players are partnering with local developers to introduce advanced envelope solutions. The region’s strong focus on sustainability and iconic architectural projects is expected to fuel significant demand growth.

Building Envelope Market Top Companies

- Rockwool International – Provides stone wool insulation for thermal, acoustic, and fire protection in envelopes.

- Alcoa Corporation – Supplies aluminum for curtain walls, façades, and window framing systems.

- Johnson Controls – Offers integrated building automation systems improving envelope efficiency.

- BASF SE – Develops insulation foams, sealants, and coatings enhancing envelope performance.

- USG Corporation – Manufactures sheathing and weather barriers used in wall systems.

- Nichiha Corporation – Produces fiber cement cladding for durable, aesthetic façades.

- Boral Limited – Supplies exterior cladding and roofing materials.

- LafargeHolcim – Provides façade systems using concrete and cementitious panels.

- ArcelorMittal – Delivers steel solutions for structural envelope systems.

- Tata Steel – Offers pre-finished steel cladding and roofing products.

More Insights in Towards Chemical and Materials:

- Green Building Materials Market : The global green building materials market volume was reached at 600 million tons in 2024 and is expected to be worth around 1,271.6 million tons by 2034, growing at a compound annual growth rate (CAGR) of 7.80% over the forecast period 2025 to 2034.

- Materials Informatics Market : The global materials informatics market size was valued at USD 173.19 billion in 2024. The market is projected to grow from USD 209.30 billion in 2025 to USD 1,150.77 billion by 2034, exhibiting a CAGR of 20.85% during the forecast period.

- Building & Construction Materials Market : The global building and construction materials market size was valued at USD 2.19 trillion in 2024, grew to USD 2.32 trillion in 2025, and is expected to hit around USD 3.90 trillion by 2034, growing at a compound annual growth rate (CAGR) of 5.95% over the forecast period from 2025 to 2034.

- Recycled Plastics In Green Building Materials Market : The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034.

- Europe Green Building Materials Market : The Europe green building materials market volume was reached at 169.9 million tons in 2024 and is expected to be worth around 406.7 million tons by 2034, growing at a compound annual growth rate (CAGR) of 9.12% over the forecast period 2025 to 2034.

- Magnetic Materials Market ; The global magnetic materials market size was accounted for USD 33.19 billion in 2024 and is expected to be worth around USD 58.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.75% during the forecast period 2025 to 2034.

- Building Materials Market : The global building materials market size was approximately USD 1.45 trillion in 2024 and is projected to reach around USD 2.17 trillion by 2034, with an estimated compound annual growth rate (CAGR) of about 4.11% between 2025 and 2034.

- U.S. Recycled Plastics in Green Building Materials Market : The U.S. recycled plastics in green building materials market size was reached at USD 846.20 million in 2024 and is expected to be worth around USD 1,941.65 million by 2034, growing at a compound annual growth rate (CAGR) of 8.66% over the forecast period 2025 to 2034.

- U.S. Biomaterials Market : The U.S. biomaterials market size was valued at USD 68.16 billion in 2024, grew to USD 78.29 billion in 2025, and is expected to hit around USD 272.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.85% over the forecast period from 2025 to 2034.

- Aluminum Composite Materials Market : The global aluminum composite materials market size is calculated at USD 3.84 billion in 2024, grew to USD 4.14 billion in 2025, and is projected to reach around USD 8.18 billion by 2034. The market is expanding at a CAGR of 7.85% between 2025 and 2034.

- Biomaterials Market : The global biomaterials market size was valued at USD 171.85 billion in 2024 and is anticipated to reach around USD 526.63 billion by 2034, growing at a CAGR of 11.85% from 2025 to 2034.

- Advanced Materials Market : The global advanced materials market size was valued at USD 69.45 billion in 2024 and is expected to reach around USD 128.06 billion by 2034, growing at a CAGR of 6.31% from 2025 to 2034.

Building Envelope Market Top Key Companies:

- Rockwool International A/S

- Alcoa Corporation

- Johnson Controls

- BASF SE

- USG Corporation

- Nichiha Corporation

- Boral Limited

- LafargeHolcim

- ArcelorMittal

- Tata Steel Limited

- Fletcher Building Limited

- Knauf Insulation

- Xella Group

- Etex Group

- CSR Limited

- Zhejiang Zhongtai Glass Co., Ltd.

Recent Development

- In March 2025, bailey announced the acquisition of The Parkside Group’s assets to integrate Comar aluminium systems and Axim hardware into its portfolio, expanding its envelope product range to include façade, curtain wall, window, and door systems. The move strengthens Bailey’s position in providing end to end building develop solutions.

- In July 2025, TopBuild completed its purchase of Progressive Roofing, adding commercial roofing capability to its existing insulation and envelop services. The acquisition enables TopBuild to offer more comprehensive building envelope solutions across roofing and façade segments.

- In January 2025, Saint-Gobain completed the acquisition of OVNIVER Group in Mexico & Central America, further strengthening its worldwide presence in construction chemicals

- In June 2025, Sika acquired Gulf Additive Factory LLC in the State of Qatar. The acquisition strengthens Sika’s foothold in the country and provides exciting opportunities for further expansion.

Building Envelope Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Building Envelope Market

By Material Type

- Concrete

- Glass

- Metal

- Wood

- Stone

- Other Materials

By Product Type

- Wall Systems

- Curtain Wall Systems

- Cladding

- Insulation

- Roof Systems

- Green Roof Systems

- Roof Windows

- Roof Insulation

- Window & Doors

- Windows

- Doors

- Skylights

- Floor Systems

- Floor Insulation

- Floor Coverings

- Others

By Building Type

- Residential Buildings

- Single-Family Homes

- Multi-Family Homes

- Commercial Buildings

- Office Buildings

- Retail Buildings

- Hospitals & Healthcare

- Educational Institutions

- Industrial Buildings

- Institutional Buildings

By Technology

- Traditional Building Envelope Solutions

- Smart & Energy-Efficient Building Envelope Solutions

- Energy-Efficient Windows

- Insulation Materials

- Thermally Efficient Materials

- Ventilation Systems

- Solar-Integrated Building Envelopes

- Transparent Solar Panels

By Installation Type

- New Construction

- Renovation & Retrofitting

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5889

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.