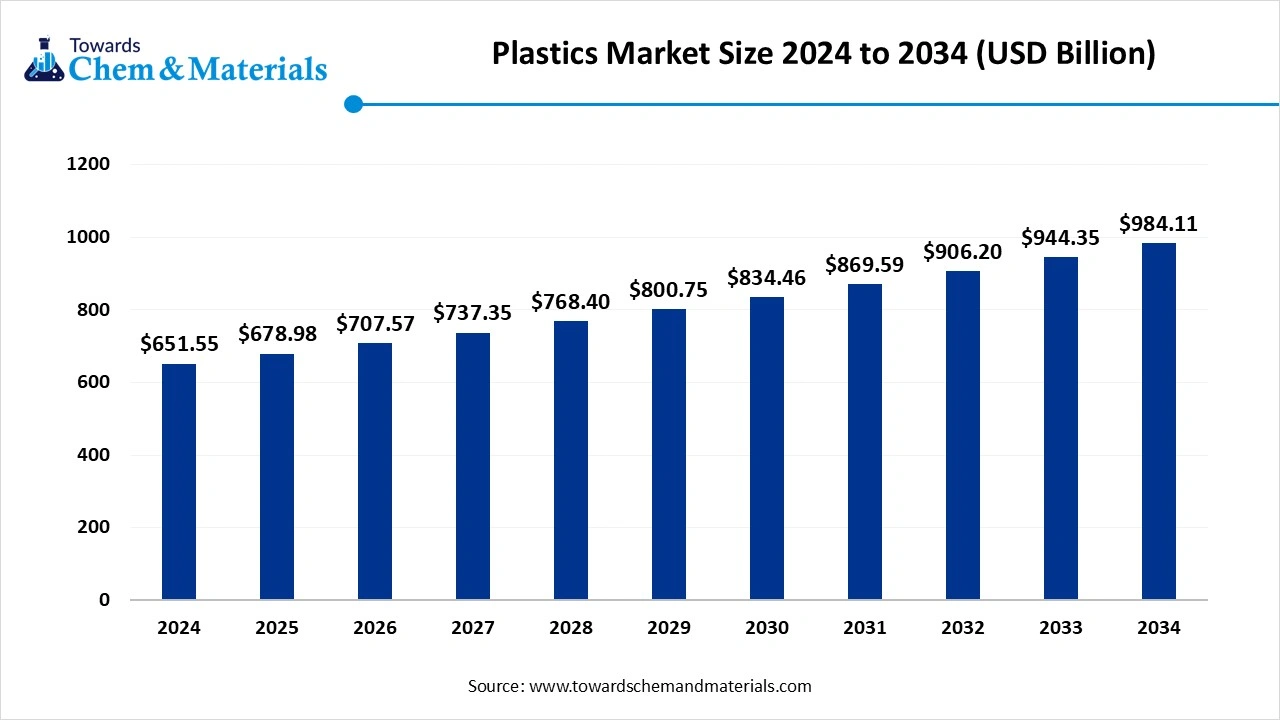

Plastics Market Size to Worth Around USD 984.11 Billion by 2034

According to Towards Chemical and Materials, the global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

Ottawa, Sept. 12, 2025 (GLOBE NEWSWIRE) -- The global plastics market size is valued at USD 678.98 billion in 2025 and is anticipated to reach around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The growth of the market is driven by the growing demand for lightweight and durable materials in automotive and packaging industries is driving the market growth.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5821

Plastics Market Overview

The global plastics market encompasses both synthetic and bio based polymers shaped for myriad uses across sectors like packaging, construction, automotive, electronics, textiles, healthcare, and consumer goods. Historically rooted in petrochemical feedstock such as polyethylene, propylene, PVC, and polystyrene, the industry is increasingly embracing renewable and bio based alternatives. Market expansion is being fueled by plastics inherent advantages lightweight, durability, versatility and bolstered by rapid industrialization, urbanization, and rising demand in packaging and automotive electronics. Technological innovations, including advanced polymer chemistries, automation, and additive manufacturing techniques like 3D printing, are enhancing efficiency and unlocking new application frontiers. Concurrently, growing environmental concerns and regulatory pressures are accelerating the shift toward circular solutions, prompting a stringer focus in recycling infrastructure and bioplastics. These sustainability driven developments are positioning industry for a future where performance and ecological responsibility go hand in hand.

Plastic Market Report Highlights

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 50% share in the market in 2024. The growth of the market is driven by rapid industrialization.

- By polymer type, the polyethylene (PE – LDPE, LLDPE, HDPE) segment dominated the market in 2024. The polyethylene (PE – LDPE, LLDPE, HDPE) segment held approximately 30% share in the market in 2024. Its versatility, cost-effectiveness, and recyclability support its continued dominance.

- By source, the petrochemical-based plastics segment dominated the market in 2024. The petrochemical-based plastics segment held approximately 85% share in the market in 2024. They are the backbone of the packaging, automotive, electronics, and construction industries.

- By processing technology, the injection molding segment dominated the market in 2024. The injection molding segment held approximately 35% share in the market in 2024. It is widely applied in automotive parts, packaging containers, electronics housings, and healthcare devices

- By application, the packaging (rigid & flexible) segment dominated the market in 2024. The packaging (rigid & flexible) segment held approximately 40% share in the market in 2024. The cost-effective properties increase the adoption of the market.

- By end-use industry, the packaging & consumer goods segment dominated the market in 2024. The packaging & consumer goods segment held approximately 45% share in the market in 2024. The versatility and durability increase the growth of the market.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5821

Plastic Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 678.98 Billion |

| Revenue forecast in 2034 | USD 984.11 Billion |

| Growth rate | CAGR of 4.21% from 2025 to 2034 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative Units | Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2035 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Polymer Type, By Source, By Processing Technology, By Application, By End-Use Industry, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Key companies profiled | BASF SE; SABIC; Dow, Inc.; DuPont; Evonik Industries AG; Sumitomo Chemical Co., Ltd.; Arkema; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Co., LLC; Lotte Chemical Corporation; Exxon Mobil Corporation; Formosa Plastics Corporation; Covestro AG; Toray Industries, Inc.; Mitsui & Co. Plastics Ltd.; TEIJIN LIMITED; INEOS Group; Eni S.p.A.; LG Chem; LANXESS; CHIMEI; Huntsman International LLC; Chevron Phillips Chemical Co., LLC; LyondellBasell Industries B.V.; RTP Company |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Critical Levers to Reduce the Environmental Impact of Plastics

- Develop recycled plastics markets by combining push and pull policies. While global production of secondary plastics from recycling has more than quadrupled in the last two decades, they are still only 6% of the total feedstock. Since secondary plastics are mainly considered substitutes for primary plastics, rather than a valuable resource in their own right, the secondary plastics market remains small and vulnerable. Some countries have successfully strengthened their markets by “pushing” secondary plastics supply – for example, through extended producer responsibility schemes – as well as “pulling” demand via recycled content targets. The recent decoupling of prices for primary and secondary polyethylene terephthalate (PET) in Europe and increasing innovation in recycling technologies are positive signs that the combination of these policies is working.

- Boost innovation for a more circular plastics lifecycle. Innovation can deliver significant environmental benefits – by reducing the amount of primary plastics needed, prolonging the useful life of products and facilitating recycling. This report shows that patented environmental plastics technologies increased more than threefold between 1990 and 2017. Yet innovation in waste prevention and recycling makes up only 1.2% of all plastics-related innovation. More ambitious policies are needed including a combination of investments in innovation and interventions aimed at increasing demand for circular solutions while restraining plastics consumption overall.

-

Strengthen the ambition of domestic public policies. An inventory of key regulatory and economic instruments in 50 OECD, emerging and developing countries developed for this report suggests that the current plastics policy landscape is fragmented and can be strengthened significantly. Only 13 countries from the inventory have national policy instruments in place that provide direct financial incentives to sort plastic waste at source. Only 25 of the countries in the inventory have effectively implemented well-known instruments that encourage recycling, such as national landfill and incineration taxes. Meanwhile, globally more than 120 countries have bans and taxes on single-use plastic items, but most are limited to plastic bags or other small-volume items. This means that these instruments are mainly effective in reducing littering, rather than restraining overall consumption of plastics. A policy roadmap is proposed for countries to reduce the leakage of macroplastics. It involves three increasingly ambitious phases:

- Close leakage pathways. Build sanitary waste management infrastructure, organise waste collection and structurally reduce plastics littering by enlarging the scope of anti-littering policies (bans or taxes of frequently littered items) and enhancing implementation of legislation.

- Create incentives for recycling and enhance sorting at source. The required measures include extended producer responsibility (EPR) schemes, landfill taxes and incineration taxes, as well as deposit-refund and pay-as-you-throw schemes.

- Restrain demand and optimise design to make plastic value chains more circular and recycled plastics more price competitive. Instruments such as plastics taxes and recycled content targets can create financial incentives to reduce use and foster circularity. Their impact could be improved considerably by extending them to more product types and more countries.

-

Strengthen international co-operation to make plastics value chains more circular and achieve net zero plastic leakage. Considering global value chains and international trade in plastics, aligning design approaches and the regulation of chemical substances across countries will be key to improving the circularity of plastics globally. Moreover, with mismanaged waste a widespread problem, especially in developing countries, major investments in basic waste management infrastructure are needed. To finance the required estimated costs of EUR 25 billion a year in low and middle-income countries, all available sources of funding will need to be mobilised, including official development assistance which currently covers only 2% of the financing needs. Efficient use of such investments will also require effective legal frameworks to enforce disposal obligations.

The Plastics Market Trends in 2025?

- Sustainability- there’s a strong shift toward recyclable and biodegradable plastics, accompanied by investments in advanced recycling technologies to reduce environmental impact.

- Smart Manufacturing- the plastics industry is integrating AI driven automation to boost efficiency, productivity, and precision in manufacturing processes.

- Additive Manufacturing (3D Printing)- Growing use of 3D printing is unlocking opportunities for highly customized, complex plastic components with less material waste.

- Specialty and engineering plastics- Demand is rising for engineering grade plastics, valued for their light weight, durability and cost effectiveness specially in automotive and other high performance sectors.

Here Are Some Of The Top Products In Plastics Market

- Polyethylene (PE)- Most widely used plastic; used in packaging (films, bags), containers, and pipes.

- Polypropylene (PP)- Lightweight, versatile; used in automotive parts, packaging, textiles, and medical products.

- Polyvinyl Chloride (PVC)- Rigid/flexible forms; used in construction (pipes, windows), cables, and medical tubing.

- Polystyrene (PS)- Used in disposable cutlery, packaging foam (EPS), and insulation.

- Polyethylene Terephthalate (PET)- Common in beverage bottles, food containers, and synthetic fibers (textiles).

- Polycarbonate (PC)- High strength and transparency; used in electronics, eyewear lenses, and medical devices.

- Polyamide (Nylon)- Engineering plastic used in automotive, textiles, and industrial parts.

- Acrylonitrile Butadiene Styrene (ABS)- Tough, impact-resistant; used in consumer electronics, toys (e.g., LEGO), and appliances.

- Polyurethane (PU)- Used in foams for furniture, insulation, footwear, and automotive seating.

- Polylactic Acid (PLA)- Biodegradable bioplastic used in packaging, 3D printing, and disposable medical items.

Plastics Market Growth Factors

Why Is Asia Pacific the Powerhouse of Plastic Demand?

The plastics market continues to surge, notably in the Asia Pacific region, where relentless industrialization and large-scale urban development are fuelling demand. Cities across China, India, and Southeast Asia are rapidly expanding infrastructure, manufacturing, and consumer goods sectors each deeply reliant on plastics for packaging, building materials, and automotive components. This grounds level push from evolving middle class consumption patterns and industrial capacity has positioned Asia Pacific as a dominant force in plastics demand.

How Are Sustainability Pressures Steering the Plastics Market?

Environmental regulation and societal concern over waste are reshaping the plastics landscape. Businesses and governments are increasingly adopting recyclable and biodegradable materials, investing in recycling infrastructure, and embracing circular economy principals. This shift from petrochemical heavy supply toward bioplastics, recycling, and end of life solutions is not just regulatory compliance, it’s a response to growing consumer and policy pressure for sustainable alternatives.

Market Opportunity

Could Recycled Content Be Plastics Next Power Move?

Consumer and businesses are increasingly demanding recycled content in plastic products, pushing manufacturers to pivot toward circular solutions. This opens a growth opportunity for firms specializing in high quality recycled plastics especially those that can embedded recycled material without comprising performance. Innovating in recycling technologies and designing for recyclability are becoming strategic differentiators, allowing brands to align with sustainability expectations and regulatory requirements while tapping into a rising wave of eco conscious demand.

Is Biodegradability the New Frontier for Plastics Market?

The growing appetite for biodegradable plastics capable of breaking down naturally presents a compelling opportunity to capture new market segments. These materials are particularly compelling for applications in packaging, food delivery, and other areas where both performance and environmental impact matter. Companies that can develop specialty bioplastics balancing functionality and composability stand to benefit from shifting consumer priorities and tighter regulations on single use plastics.

Limitations In the Plastics Market

- High Production Costs of Sustainable and Specialty Plastics- Bioplastics, bio based biodegradable, and advanced polymers like biopharma grade plastics often face steep production costs. This is driven by the need for specialized raw materials, intricate manufacturing processes, and rigours regulatory compliance. These elevated expenses make it difficult for such materials to compete on price with traditional petrochemical plastics, specially in cost conscious sectors like packaging and FMGC.

- Fragmented infrastructural and Limited Recycling Capacity- Many regions lack sufficient infrastructure to support effective recycling or composting of plastics. This includes low coverage of industrial composting facilities for biodegradable materials, inadequate sorting and material recovery systems, and limited access to recycling centres specially in rural and underserved areas. The absence of supportive infrastructure undermines the sustainability claims of novel plastics and constraints their adoption.

Why Is Asia Pacific Dominating the Global Plastics Market?

Asia Pacific dominated the market in 2024. Asia Pacific stands out as the dominant region in the global plastics market, driven by its fast paced industrialization, robust manufacturing capabilities, and massive consumer demand. Dynamic economies such as China, India, Japan, and Southeast Asian nations are fuelling usage across key sectors including packaging, automotive, electronics, and construction. Moreover, the region is proactively investing in recycling infrastructure and sustainable alternatives to meet rising environmental expectation, solidifying its position as a powerhouse in both consumption and innovation within the plastics arena.

India, in particular, is increasingly influential in the plastics market, thanks to its rapid urban growth, expanding middle class, and heightened demand in sectors like packaging (specially food and beverages), automotive and construction. Government campaigns such as “Make in India” and efforts to enhance recycling systems are shaping how the market evolves, while accelerating investments in bioplastics and circular economy initiatives position India as innovation centric, high growth market in plastics landscape.

Why Is Europe Emerging As The Fastest Growing Region In The Plastics Market?

Europe is expected to grow at the fastest rate in the market during the forecast period of 2025 to 20234. The region is characterized by ambitious recycling targets and bans on single use plastics, alongside aggressive circular economy initiatives that are accelerating the shift toward recycled and bio based polymers. These regulatory drivers are prompting manufacturers to invest heavily in advanced polymer technologies, 3D printing materials, and high performance plastics that align with environmental objectives. At the same time, industries such as automotive, packaging and healthcare are increasingly adopting lightweight, recyclable and eco-friendly plastic solutions, further reinforcing Europe’s role as a leader in sustainable plastics transformation.

Plastics Market Market Segmentation Insights

Polymer Type Insights

Why Is Polyethylene The Backbone Of Plastics?

The polyethylene (PE-LDPE, LLDPE, HDPE) segment dominated the market in 2024. Polyethylene remains a cornerstone of the industry due to its versatility, cost effectiveness, and widespread use in packaging, agriculture films, container, and consumer goods. Its strength, flexibility, and recyclability make it indispensable across industries. Furthermore, advancements in polymer chemistry and sustainable variants of polyethylene continue to strengthen its market relevance.

The Polypropylene (PP) and bio based plastics segment is expected to grow at the fastest rate between 2025 and 2034. This is driven by demand for lightweight automotive components, medical devices, and ecofriendly alternatives.

Source Insights

Why Do Petrochemical Based Plastics Still The Plastics Market?

The petrochemical based plastics segment dominated the market in 2024. Their dominance arises from the vast, established petrochemical infrastructure and the affordability of feedstock’s that enable large scale production. These plastics, such as polyethylene, polypropylene, PVC polystyrene, remain integral to packaging construction, and consumer goods. Despite sustainability pressures their mechanical properties and production economics make them highly competitive in mainstream application.

The bio based and biodegradable plastics segment is expected to experience fastest growth during 2025 to 2034, owing to global sustainability targets, rising consumer awareness, and regulations restricting single use plastics.

Processing Technology Insights

Why Did Injection Molding Preferred Processing Technology?

The injection molding segment dominated the market in 2024. Injection molding dominated because of its ability to produce complex, high volume, and cost efficient components with consistent quality. This technology is widely used in packaging, automotive parts, consumer products, and electronics. Its scalability and compatibility with diverse polymers have kept it at the forefront of plastic manufacturing techniques.

The 3D printing/additive manufacturing segment is expected to experience the fastest growth from 2025 to 2034, as industries increasingly adopt advanced manufacturing for customization, lightweight designs and rapid prototyping.

Application Insights

Why Is Packaging The Leading Application Plastics Market?

The packaging (rigid and flexible) segment dominated the market in 2024. Plastics lightweight durable, and protective nature makes them ideal for both flexible and rigid packaging, from food and beverages to personal care and industrial goods. The rise of e-commerce, convenience products, and demand for extended shelf life further support plastics stronghold in packaging. Sustainability initiatives, including recyclable and biodegradable packaging solutions, are also shaping the segment’s evolution.

The healthcare and medical devices segment is anticipated to grow with the highest CAGR from 2025 to 2034, fuelled by increased demand for safe, sterile and lightweight plastic materials in syringes, implants PPE, and diagnostic equipment.

End Use Industry Insight

Why Do Packaging And Consumer Goods Drive End Use Demand?

The packaging & consumer goods segment dominated the market in 2024. This dominance reflects the heavy reliance of everyday products ranging from food packaging to household items on plastics flexibility, affordability, and durability. Consumer lifestyle changes, the boom in fast moving consumer goods (FMCG), and expansion of retail and e-commerce sectors have all reinforced plastics central role in this segment.

The automotive and transportation (Lightweight trend) segment is projected to expand rapidly between 2025 and 2034, driven by the global push for fuel efficiency, emission reduction, electric vehicle adoption.

More Insights in Towards Chemical and Materials:

- Biodegradable Plastics Market : The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034.

- Recycled Plastics In Green Building Materials Market : The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034.

- Transparent Plastics Market ; The global transparent plastics market size was reached at USD 151.53 billion in 2024 and is expected to be worth around USD 245.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.93% over the forecast period 2025 to 2034.

- Plastics Extruded Market : The global plastics extruded market size was reached at USD 175.96 billion in 2024 and is expected to be worth around USD 259.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.95% over the forecast period 2025 to 2034.

- Bioplastics Market : The global bioplastics market volume was reached at 11,40,000.0 tons in 2024 and is expected to be worth around 73,21,706.6 tons by 2034, growing at a compound annual growth rate (CAGR) of 20.44% over the forecast period 2025 to 2034.

- Engineering Plastics Market : The global engineering plastics market size was reached at USD 146.95 billion in 2024 and is expected to be worth around USD 312.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.85% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics Market : The U.S. recycled plastics market size was reached at USD 52.85 billion in 2024 and is expected to be worth around USD 131.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.53% over the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Sustainable Plastics Market : The global sustainable plastics market size was reached at USD 410.73 billion in 2024 and is expected to be worth around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period 2025 to 2034.

- Circular Plastics Market : The global circular plastics market size was reached at USD 73.19 billion in 2024 and is expected to be worth around USD 182.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.55% over the forecast period 2025 to 2034.

- U.S. Plastics Market : The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

- U.S. Transparent Plastics Market : The U.S. transparent plastics market size was reached at USD 20.02 billion in 2024 and is expected to be worth around USD 35.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics in Green Building Materials Market ; The U.S. recycled plastics in green building materials market size was reached at USD 846.20 million in 2024 and is expected to be worth around USD 1,941.65 million by 2034, growing at a compound annual growth rate (CAGR) of 8.66% over the forecast period 2025 to 2034.

- Europe Plastics Market ; The Europe plastics market volume was reached at 55.10 million tons in 2024 and is expected to be worth around 64.32 million tons by 2034, growing at a compound annual growth rate (CAGR) of 1.56% over the forecast period 2025 to 2034.

Plastics Market Top Key Companies:

- ExxonMobil Chemical

- LyondellBasell Industries

- SABIC: (Saudi Basic Industries Corporation)

- BASF SE

- Dow Inc. (formerly Dow Chemical)

- INEOS

- Reliance Industries

- TotalEnergies

- Chevron Phillips Chemical Co. LLC

- Formosa Plastics Corporation

- Covestro AG

- DuPont

- Evonik Industries AG

- Celanese Corporation

Recent Developments

- In August 2025, the United Nations Development Programme in Jordan (UNDP), in partnership with the Municipality of Deir Alla, announced the launch of a new plastic recycling plant through European Union funding

- In March 2025, Italian energy company Eni, through its chemical division Versalis, has launched a new facility in Porto Marghera that produces plastics using mechanically recycled materials. This initiative reflects Eni’s strategic shift from traditional chemicals toward sustainable solutions like recycling, bio-refining and energy storage as part of a multi-billion euro transformation plan.

-

In September 2025, styropek a plastics company near Pittsburgh agreed to pay $2.6 million to settle claims over illegal dishcharge of microplastic “nurdles” into local watereays. Though the pant is inactive, the settlement mandates installation of population control systems should operations resume signalling growing regulatory and environmental crutiny on plastic waste.

Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Plastics Market

By Polymer Type

- Polyethylene (PE – LDPE, LLDPE, HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS) & Expanded Polystyrene (EPS)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Others (Nylon, PMMA, etc.)

By Source

- Petrochemical-Based Plastics

- Bio-Based & Biodegradable Plastics

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Rotational Molding

- Compression Molding

- Thermoforming

- 3D Printing/Additive Manufacturing

By Application

- Packaging (rigid & flexible)

- Building & Construction (pipes, insulation, profiles)

- Automotive & Transportation (interiors, exteriors, components)

- Electrical & Electronics (cables, enclosures, devices)

- Consumer Goods (household, furniture, sports goods)

- Textiles & Apparel (fibers, nonwovens)

- Healthcare & Medical Devices

- Agriculture (films, greenhouse covers, irrigation)

- Industrial & Machinery

- Others

By End-Use Industry

- Packaging & Consumer Goods

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Healthcare & Medical

- Textiles & Fashion

- Agriculture

- Industrial & Machinery

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5821

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.